I lived my early adult life in a hurry — graduating from a combined five-year program with my BS and MBA, getting married three weeks later, and starting an all-consuming career at McKinsey the following month. Looking back, I realize how lucky I was to have wagered so much of my time on career pursuits — betting on a patient husband, our fertility after 35, and elderly parents well outliving the life expectancy tables.

Thirty years later, I had a very different mindset when I embarked on my portfolio life stage, shifting from a dedicated C-suite role to serving as a director on multiple corporate boards. Somewhere along the way, I realized that time is my most precious resource: I need to be as mindful of how I invest my time as money. Fortunately, many of the same portfolio management principles apply — and even small early investments compound to significant downstream gains.

Invest your life where it matters most

Despite our countless personal differences, most of us share a few common goals. We want to live a comfortable life. We want to leave a legacy behind. And, in the end, we hope to be able to look back with no regret. Much like managing your financial portfolio, investing your time starts with clearly identifying your asset classes — those broad experiential buckets you long to fill to ensure your life has meaning.

Whereas investment discussions often weigh stocks versus bonds, work-life balance typically focuses on professional versus personal. Over time, I recognized that my work life had many outside influencers shaping my SMART goals. But I needed to be more deliberate in defining family and “me” goals. Over a decade ago, I developed a simple mnemonic to add a list of FEATS to the mix — Family, Exercise, Arts, Travel, and Spiritual.

Having FEATS inspired me to host the extended family reunion, add a Peloton ride to my daily workout, remaster that piano recital piece from high school, visit China and Russia (in times of friendlier US relations), and reread both Testaments of the Bible. These investment classes became critical for me to lead a personally fulfilling life.

Apportion time to protect priorities

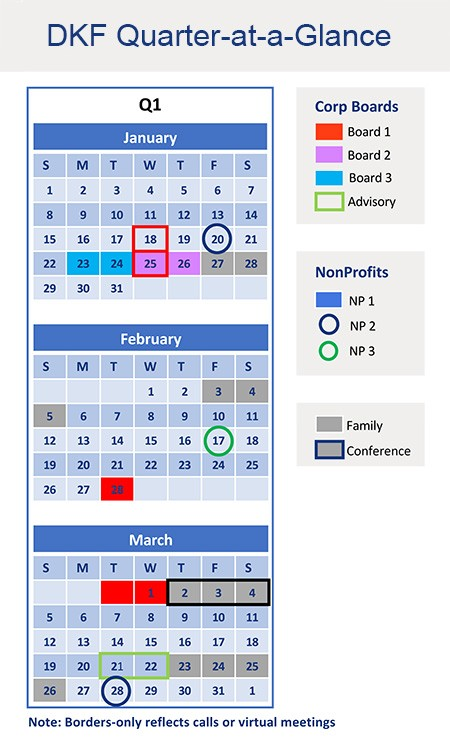

Target allocations help ensure you’re not just spending your time but investing it. I start by blocking out the significant immovable schedule commitments anchoring my professional calendar. Then, with that framework laid, I can fill in the gaps and “solve for personal.” I first demarcate quarterly commitments and calendar milestones for all the boards I serve. Then, I’ll block off time for multi-day professional education and conferences (lifelong learning also feeds my Spiritual soul). With these anchor investments funded, I can ringfence time for other personal and family commitments like holiday celebrations, long weekend getaways, and significant travel adventures.

My next step is establishing weekly guardrails to protect time in my portfolio from being filled by non-urgent work. These aren’t black and white, as they must sometimes flex (e.g., I have different versions for travel and non-travel weeks). As a churchgoer since childhood, I have long earmarked Sunday mornings for spiritual pursuits. In 2020, my parents’ senior community emerged from the Covid lockdown with a weekly “one visitor/one entry” rule. I shuffled my agenda to clear Fridays from lunch on and have sustained the routine ever since. It means I shift a half day of work to the weekend, but the return is well worth it.

Don’t underestimate the power of daily routines in combatting the scope creep of an “always-on” work culture. For me, every weekday morning begins with a 90-minute exercise workout. When my daughter was younger, I split my workday into two chunks, business hours and after her bedtime — with a sacrosanct 7:15 pm family dinner in between. Although we are now empty-nesters, I am still most productive in those uninterrupted evening hours. Investing attention to being fully present at home ensures my continued ability to be fully present in my work.

Keep on track by managing minutes and “counting steps”

It’s easy to make a plan. It’s another thing entirely to follow it. Key performance indicators are those tools and measures you use to keep yourself honest and on strategy. That meant tracking how I invested my time among clients and Firm-related work each week at McKinsey. Old habits die hard: I still log my weekly time in an Excel spreadsheet that lists my boards, education/networking, community, family, and personal pursuits. But many will find this approach is overkill.

Fortunately, self-assessment needn’t be this extreme to be effective. Sometimes simple is better. Measuring whether you’re a good parent any given week may be challenging. But it’s easy to log the number of nights you made it home from the office early enough to read your daughter a bedtime story. Likewise, my exercise goal started as walking at least 10,000 steps daily (which I’ve achieved every day for the past two decades!).

Simple yardsticks can provide personal insights too valuable to ignore. We all go through ups and downs, ebbs and flows. The volatility of life can drive imbalances between where you intend to invest your time and where you actually spend it. But if you see an extended mismatch over the long term, it may be time to rethink, reprioritize, or rebalance — just as you would with financial investments.

Compound your interests for a life fully leveraged

For better or worse, there are only 168 hours in a week — whether you’re at the bottom of the org chart or chair the board. One of the most effective tools for maximizing return on your time investment is strategically putting the same hour to work simultaneously in multiple asset classes. As with margin trading, leveraging each moment can double or triple the payoff.

My monthly Audible subscription transforms everything from routine errands to long-distance commutes into my executive education classroom, where I’ve completed over 100 nonfiction books in the past five years. By contrast, streaming videos on my iPad is a guilty pleasure (e.g., all eight seasons of Game of Thrones, “mockumentaries” of failed tech entrepreneurs). It speeds my hour on the treadmill, and close captioning helps me breeze through even noisy chores like vacuuming or blow-drying my hair.

Harmonizing interests can be a valuable way to maximize family time. My nonprofit board service in the arts sparked a decade of Broadway spring break trips — and my daughter’s upcoming graduation as a Northwestern theatre management major. My Ironman husband’s love for cycling encouraged me to get an indoor-cycling bike (and influenced our daughter to start running). This summer, the three of us will celebrate her graduation with a Backroads biking trip to the Netherlands and Belgium. What better way to combine my love of Family with our shared passions for Exercise, the Arts, and Travel!

A more obvious tactic for maximizing return on your time: just say no! Whether this means outsourcing tasks you don’t enjoy (e.g., housekeeping, ironing), sharing with your partner (e.g., my husband enjoys cooking and I don’t), or just accepting that some things won’t happen (e.g., my email inbox is a black hole from which there is no escape), the return on your time is infinite for tasks that you don’t do.

***

Much like financial investing, life can be turbulent and rife with uncertainty. None of us knows exactly how many tomorrows tomorrow holds. When investing your time, I firmly believe that purposeful planning and honest self-assessment along the way can deliver future results. By being intentional in our choices and fully invested in each moment, we all have the potential to maximize personal fulfillment and minimize regrets.